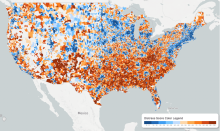

Opportunity Zones (OZs), established under the 2017 Tax Cuts and Jobs Act[1], have introduced a transformative avenue for real estate development and construction in the U.S. By offering substantial tax benefits, these OZs present a lucrative opportunity for investors and developers seeking to engage in real estate construction within these regions. This article unpacks the tax benefits and trends associated with OZs, focusing specifically on burgeoning markets for real estate development and construction.

The Attractive Tax Benefits of Opportunity Zones

Investing in OZs affords a trio of tax benefits on capital gains: deferral, reduction, and potential elimination[2]. Initially, investors can defer tax on any prior gains they reinvest in a Qualified Opportunity Fund (QOF) until the earliest of two events occurs: the investment is sold or exchanged, or December 31, 2026.

Upon holding the QOF investment for over five years, a 10% exclusion of the deferred gain applies. If held for more than seven years, the exclusion leaps to 15%.

Critically, if investors retain their stakes in the QOF for at least ten years, they are eligible for an increase in the QOF investment’s basis to its fair market value on the date it is sold or exchanged. In practical terms, this could mean zero taxable income on the investment’s appreciation[3].

Construction and Real Estate Development Trends in Opportunity Zones

After understanding the tax advantages of OZs, let’s examine the trending markets for construction and real estate development within these zones.

1. Southeast Markets

Cities in the Southeast, including Florida and North Carolina, are witnessing significant growth in their OZs’ real estate development and construction sector. For instance, Miami’s booming tech sector, growing population, and thriving tourism industry are prompting robust development. Similarly, Charlotte’s rapidly growing financial services and tech sectors in North Carolina make it a lucrative locale for real estate construction.

2. West Coast Markets

The Bay Area and Los Angeles in California have shown promising growth on the West Coast. The Bay Area’s booming tech industry creates a steady stream of high-paying jobs and a strong rental market, attracting developers and investors. With its economy’s diversity and allure to multiple industries, including technology and entertainment, Los Angeles has become an investment hotspot.

3. Midwest Markets

In the Midwest, Chicago stands out despite economic challenges. Its economic diversity and strategic location offer substantial opportunities. The city’s Opportunity Zones, particularly on the South and West sides, are starting to pique investor interest.

In summary, Opportunity Zones provide significant tax benefits driving a surge in real estate development and construction across various U.S. markets. Given the benefits and current trends, we anticipate more investment and development in these zones, offering a vital boost to underserved communities nationwide.